About

Rogue is a venture investment vehicle created by founder turned seed investor, startup strategist and speaker, Diane Henry.

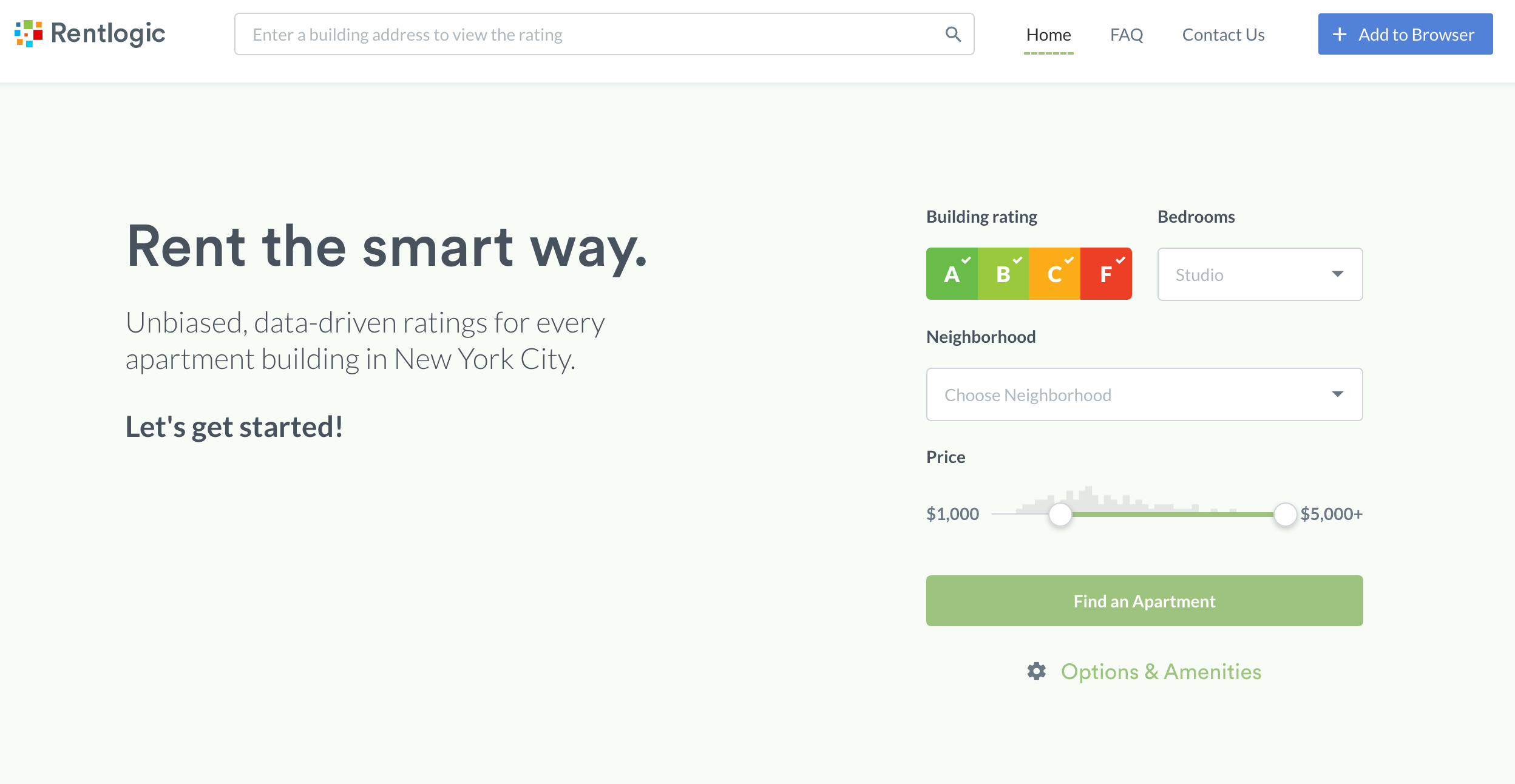

In 2015, Diane began making seed investments in top startups across the US, including then nascent tech hubs from rural Massachusetts to Atlanta Georgia to SLC Utah to Rogue’s headquarters in 'Silicon Alley’, NYC. She brings her combination of agile, purposeful leadership and entrepreneurial grit to her advisory work with young companies.

Prior to Rogue, Diane founded a Manhattan-based commercial real estate company where she bootstrapped expansion, navigated her team through multiple market meltdowns, and landed her firm a spot as a Forbes Company to Watch.

Diane speaks frequently on topics related to leadership, entrepreneurship, innovation, product development and technology ethics. The Rogue Capital Collective refers to the independent spirit and collective intelligence of the network of founders, thought leaders and fellow investors who make the Rogue vision possible.